"I told you, you have to start looking differently at the world"

The Protaginst: "Tenet"

Summary

Firstly, apologies for the two of you that read this. I was supposed to be completed last week but I am currently on a break. Unfortunately, its not on a boat in the Med..

Macro

Not a lot has changed since last month. I still stick with the market is oscillating between three probable scenarios and we keep flirting with each as sentiment ebbs and flows. Last month I wrote:

“So what are the probable scenarios? In my view they are:

Commodity head fake (30%)

Commodity prices continue to sell off, reducing cyclical inflationary pressures

Fed reduces rates to 3-3.5%

Housing markets stabilise

USD lower / Gold higher for balance of 2023

Growth over Value persists for balance of H2 2023

Commodities rear their heads in Q4 2023 or Q1 2024 and the inflationary pressures come back harder and faster.

Rates go higher faster (30%)

The services inflation stickiness persist

Commodities bounce before Q3 2023 due weather or a geopolitical event

Growth equity tumbles

Real economy goes down with the equity market

Commodities bounce hard, causing an abrupt lowering of demand (think EU energy in 2022) and the global recession is severe

USD stronger / Gold lower

Main St. Vs Wall St (40%)

Services are sticky and wage inflation persists due to collective bargaining and increased power of unions

Commodities trade in a band (e.g. oil in a $68-88 range base WTI)

House prices flat in nominal terms, lower in in real terms in the US. Housing in more rate sensitive markets in Australia, Canada and UK remain under pressure in nominal and real terms

Slower rotation back into value from growth

EM outperforms DM

USD weaker generally but more idiosyncratic depending on relative balance sheets

Fed holds firm for balance of 2023, eases a little in H1 2024. Real rates stay negative but nominal rates come lower.”

With the Fed trying to do a hawkish pause, rates have stopped going up for a little which has given global equities an excuse to run higher. US tech is still strong despite some late month wobbles. With month and quarter end on Friday, predictably flows were bullish so we have had a great first half to 2023. Whats next? I still think not much until the Europeans and US have finished their summer holidays. There is still a risk of more FOMO from real money and if they start chasing who knows where stocks could go. Bonds volatility continues to fall and whilst still high historically, this is a good thing for risk sentiment. There is a great thread from EffMktHype on Twitter that goes into the ratio of bond vol to equity vol. Worth a read. TLDR: because equity volatility is so low vs bond volatility it doesn’t mean equity vol (VIX as proxy) needs to go up.

In terms of translating a view to a chart. I think NASDAQ will have some issues punching through resistance from the old highs. Support will be at the old resistance at 13,400.

As we head into Q3 I do expect more impacts of the rate rises to flow through to some asset classes as the ability to refinance becomes tougher. Much has been written about CRE and it is the obvious poster child for this scenario of higher funding costs and lower income, but whether it turns into something systematic I do not know. It is going to be a slow moving beast and each large metro or downtown area will behave slightly differently.

Here in Australia, mortgage stress is present but has not slowed the housing market yet in a material way. Some of the faster moving data does suggest hiring freezes, restructures and layoffs are taking place in the while collar economy. Relatively higher commodity prices and a low AUD are helping mitigate some of this pain.

In the UK the resurgance of mortgage rates higher, is putting stress on the mortgage books of banks again. But like Australia you are not seeing much impact in prices.. yet. Thought some faster moving data courtesty of the FT shows this might be about to change.

If rates keep going higher and the UK banks need their mortgage books rescued I think the UK might end up with a version of Freddie Mac and Fanny Mae. I think it could be argued that the UK (and other Commonwealth countries) focus on short term financing for long term assets will come under review. Whilst the US mortgage market has a lot of issues, I think taking a 2-3 year loan on a 20-30 year asset does not make sense. Yes, you can get 5-years sometimes but the penalty rate is high but even so that does not fix the duration mismatch. In the UK maybe they could be called Godfrey and Penelope (in lieu of Freddie and Fanny). Not sure what the Australian version would be? Maybe Jason and Kylie?

Commodities

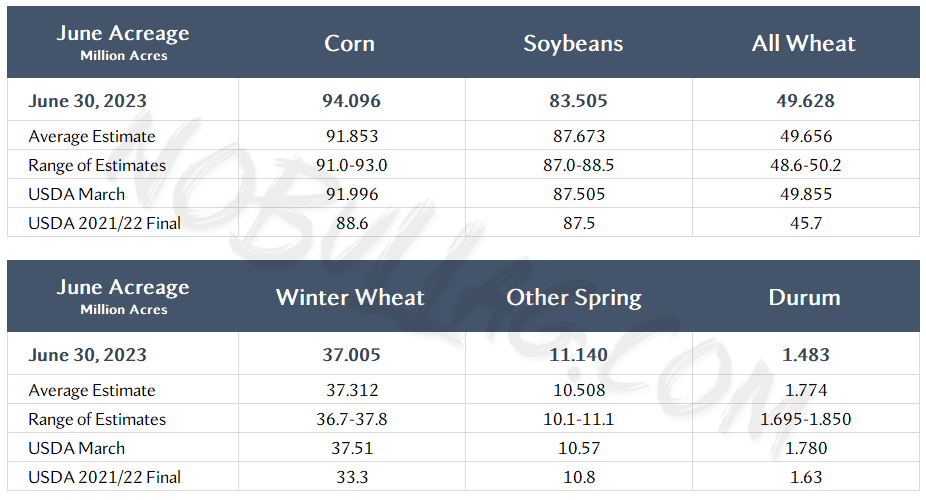

In reverse order this month, starting with agricultural markets. The biggest mover of the month was grains and oilseeds that staged a comeback due to adverse weather in the USA and large short positioning. This has resulted in a large reduction in speculative short position and lower open interest as positions were closed out. The June 30 acreage report came out on Friday and to say it was a surprise is an understatement. The table below taken from

excellent newsletter highlights the changes. I woud encourage you to read her work to keep updated on G&O markets without the hyperbole of the doomsdayers.As a consequence Soybeans pushed higher and Corn has given back all of the rally it has experienced in June plus another 5%. This sets up an interesting second half of the year in Agriculture markets with supplies being cut for certain markets, whilst demand in general remains lack lustre. For the time being South American supplies are ample and this is being expressed in the basis for Brazil soybeans and corn. But I would expect volatility to persist through July and August as we get more comfortable with yields in the US and if (when?) China demand returns.

June performance of G&O Commodities

I did promise a write up on Coffee which I need not get time to complete. The synopsis was the bullish news is already in the Arabica price, but beware Robusta, so a short Arabica vs long Robusta bet looked smart. However, as I didn’t send it out its not worth much - maybe one for Hindsight Capital to look into. I will attempt a refresh of that in the coming weeks.

Softs in general remain full of opportunities in either direction and to me offer more rational alpha generating opportunities than Grains & Oilseeds which are moving all over the place on weather, biofueld mandates and USDA reports. Good luck out there!

Macro Commodities

We saw mostly sideways to higher for the key macro commodity markets. Despite further OPEC+ cuts oil remains at the lower end of recent ranges, copper caught a bid and iron ore strengthened. As China enters a seasonally slower time for commodities, its unclear where renewed demand will come from - but the pressure on the CCP to stimulate is increasing so that remains a risk to the upside in H2 2023. I am not sure what the benefit to China is of higher commodity prices though, so I remain skeptical they will want to see crude testing $100 a barrel any time soon.

Precious metals suffered on the back of excessive positioning on the long side and a stronger USD. No tactical views on gold or silver. I had been bearish platinum. No view on prices from here.

Rather than the usual charts, what has been interesting of late regarding demand for energy transition commodities. The maths simply does not add up for the increased amount of metals that are going to be required in a short time frame. I would encourage you to listen to this HC Insider Podcast episode with Mark Mills. So perhaps the transition still happens its just delayed. This pushes back the demand for a lot of the markets that have a perceived “green energy” put written underneath them. Like oil it could be race between cutting demand expecatations for the energy transition metals, faster than supply shortages that have been well telegraphed.

Maybe we need to start thinking differently about the forward demand assumptions we have for many commodity markets?

Back to the holiday!