"Are you watching closely?"

Alfred Borden: "The Prestige"

THIS IS NOT INVESTMENT ADVICE. THE WRITER MAY OR MAY NOT HAVE POSITIONS IN THE SECURITIES OR MARKETS BEING DISCUSSED

Ramblings

So the European summer is over, oil is strong, bonds are weak and yet equities are hanging in there. We are in a macro environment where central banks have made it clear they are going to keep hiking and slowly but surely the hikes that have been priced in to 2023 have now been rolled back to 2024. In emerging markets CB’s are have started cutting rates as they seemingly have inflation under control. There is plenty of FX and bond volatility and adds to the uncertainty that persists through markets (doesn’t it always?). Year end has interesting setup. “Are you watching closely?”

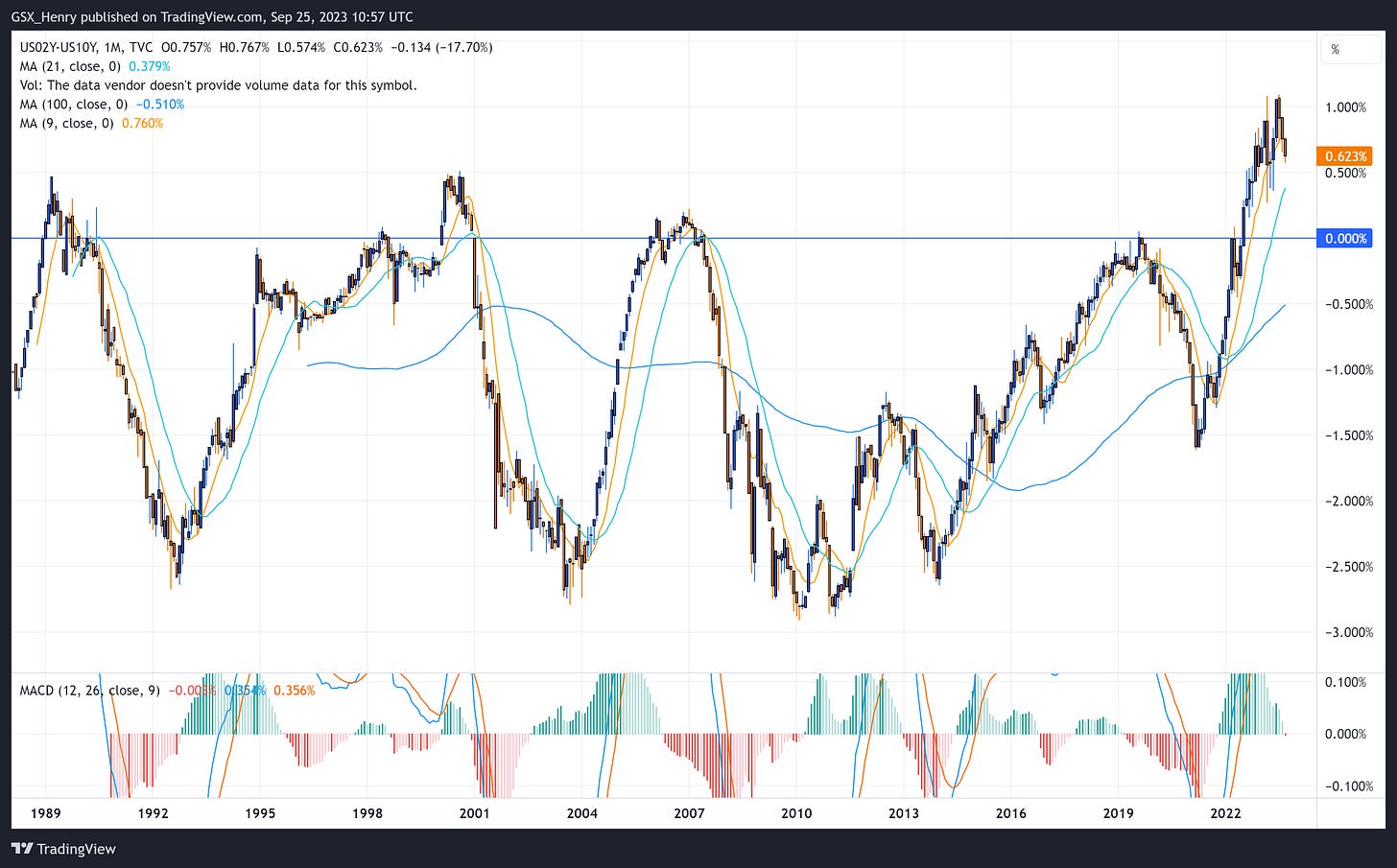

Bonds

The back end is selling off faster than the front, causing the inversion of the yield curve to narrow. This is, on balance, likely to continue. The natural buyers of duration have changed as Japan and Germany are not running large surpluses and China is not as keen to buy long dated Treasuries. That leaves households. When you can received above 5% for cash or cash equivalents, why would you want to buy 10-yrs at 4.25-4.5%? You should be earning at least another 200 bps for that. No? Whether this will predict a recession or not I will leave that to the bond “gurus” to debate but the price certainly does not make sense. If the 10-yr is “correct” then that implies the Fed should be back at their inflation target of 2% in 1-2 years…. not likely?

US 2yr-10yr Spread

Equities

Equities, led by tech remain strong but there is some dispersion in returns over the past couple of months. Since the start of August the Nasdaq (QQQ ETF) is down about 6.5%, whilst NVIDIA and AAPL are both down circa 11%, MSFT 5-6% and GOOG only 1%. Google was a laggard on the way up so in theory makes some sense but perhaps some of the AI hype is coming out of the market.

The NASDAQ Index does seem to have run out of puff at the congestion zone I have been highlighting the past couple of months.

Energy stocks are strong and likely remain so if oil continues to consolidate above $80 base WTI. The XLE energy ETF is 10% from ATH’s with Exxon leading the way. Meanwhile BP remains under pressure thanks to some C-suite musical chairs. An opportunity?

I also included a comparitive chart for the last 5 years. XLE up 20% meanwhile AAPL up 220%! So I think any oil equity bulls should be humble when they gloat…

XLE ETF

XOM

BP

Energy Markets

These markets remain on fire. The resistance I highlighted last month, was nothing more than a weak picket fence. Gasoline has started to lag, however, diesel remains well bid as refining capacity is constrained.

Weekly Chart - WTI Crude 2nd month

Relative performance of Diesel (HO) vs Gasoline (RBOB) - last 3 months

This biggest question for energy and the global economy. Do high energy prices slow the economy enough to tip it into recession? This, along with the higher for longer interest rates, remain the biggest downside risks for financial markets (and the hardest to pick the timing of). Most bearish pundits though this scenario was a sure thing in Q1 or Q2 of this year. As we almost wrap up Q3 it still has not happened. As they say, being too early as is as good as being wrong.

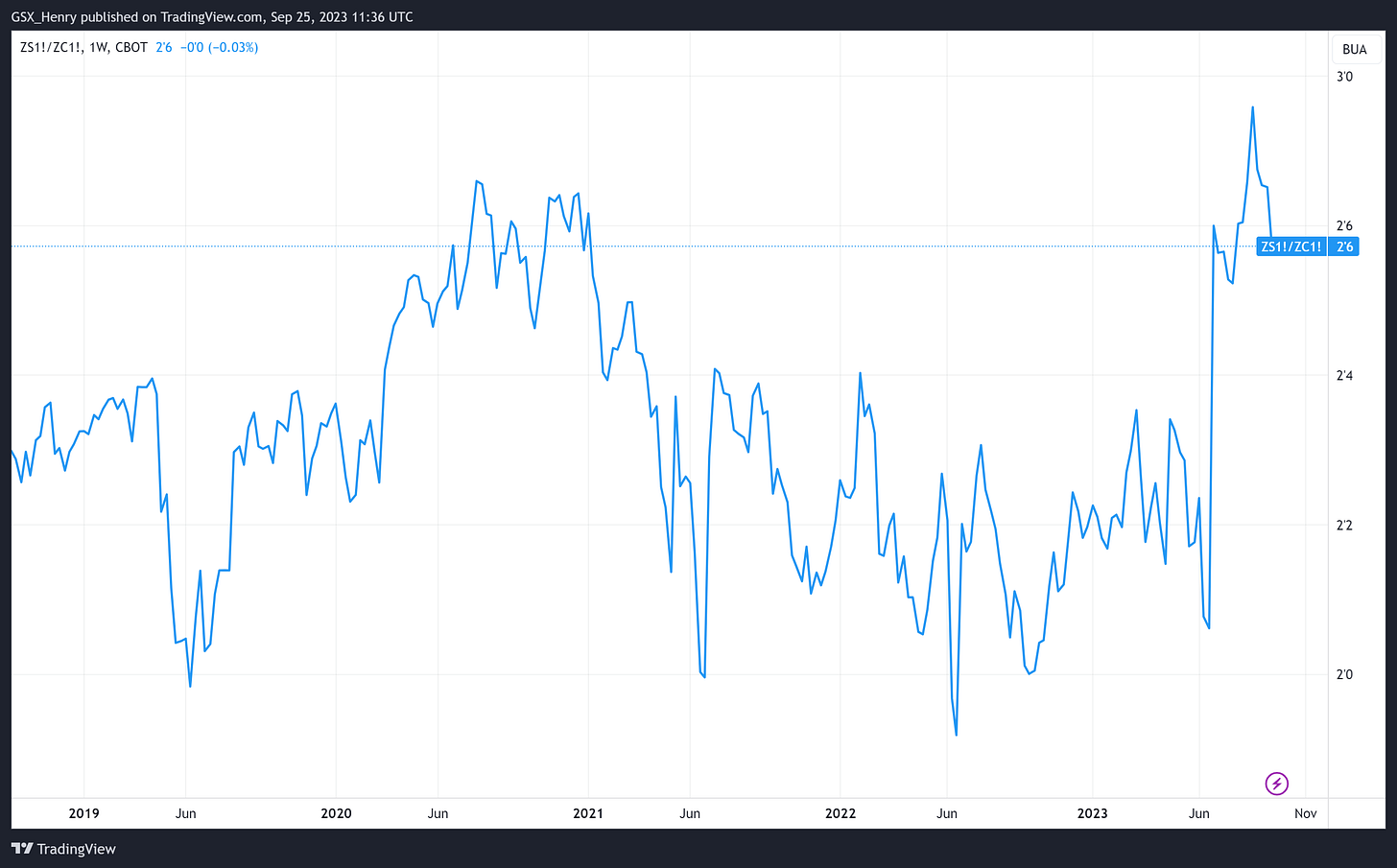

Ags/Softs

Despite lots of political noise grains remain under pressure as large supplies bring reality back to the market. There are issues in Australia with its grain crop and there has been areas dryness in North and South America this year, but we now have corn below $4.80 a bushel and wheat below $6 a bushel.

Beans are still relatively strong but are starting to get pulled down by the weight of grains and the extreme levels of the soy / corn ratio

Soy/Corn Ratio - front month continuation

So where does that leave us?

No strong views. I think front end yields are still attractive and you can be patient. Owning some tech (maybe now on a dip?) and owning some energy stocks in conjunction with some 5% + yields is not a bad place to start. If you are nimble and smarter than me you can try and trade around these three sectors but only for those with time and the risk tolerance.

Good luck out there. For those not familiar the movie. Going and check it out.

NONE OF THIS IS INVESTMENT ADVICE.

PLEASE SPEAK TO A FINANCIAL ADVISOR BEFORE MAKING ANY FINANCIAL OR INVESTMENT DECISIONS.